Highlight 1

Git-native approach ensures strong auditability, version control, and easy scenario modeling, which is especially useful for early-stage founders.

Highlight 2

Simple CLI interface allows developers and technical founders to manage equity without needing to adopt complex SaaS tools.

Highlight 3

Flexible support for common equity instruments (shares, options, SAFEs) covers the majority of early-stage financing needs.

Improvement 1

Lack of a graphical user interface may deter non-technical users who prefer a visual overview of their cap table.

Improvement 2

Limited documentation and onboarding guidance could make it challenging for first-time users unfamiliar with equity structures.

Improvement 3

No built-in integrations with accounting or legal tools, which may limit usability for startups scaling beyond the very early stage.

Product Functionality

Introduce optional integrations with legal/accounting tools and add support for more advanced financing instruments to expand usability as startups grow.

UI & UX

Develop a lightweight web dashboard or visualization layer on top of the CLI for non-technical users who prefer a visual interface.

SEO or Marketing

Create use-case tutorials, founder case studies, and comparison content against popular SaaS tools (like Carta or Pulley) to improve discoverability and adoption.

MultiLanguage Support

Provide translations of documentation and CLI help messages into major languages (e.g., Spanish, Mandarin, French) to broaden accessibility for global startup founders.

- 1

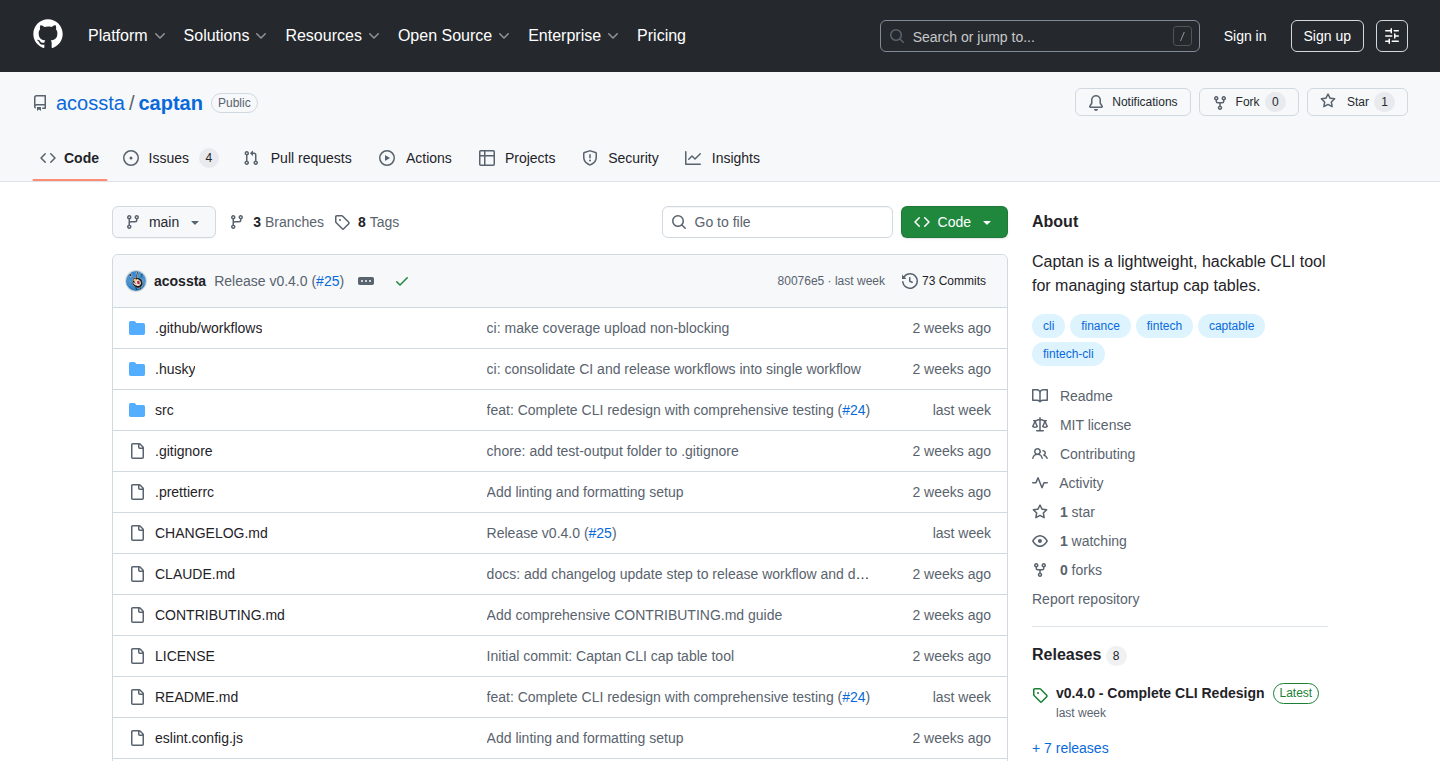

What problem does Captan solve?

Captan provides a lightweight, developer-friendly alternative to spreadsheets or expensive SaaS solutions for managing startup ownership and equity distribution.

- 2

How is Captan different from commercial cap table tools?

Unlike commercial platforms, Captan is open-source, free, Git-native, and highly transparent, allowing you to manage equity in JSON files with full version control.

- 3

Who is Captan best suited for?

Captan is ideal for early-stage founders and technical teams who want a transparent, flexible, and cost-effective way to manage equity before scaling into more complex needs.